The Definition of Procedures

Procedures represent the documentation of business process. Their purpose is to document all business processes, strategies, and principles and their related information. In terms of ISO 9000, procedures represent the Level B/Tier 2 of the Quality System. Procedures should be written in a detailed manner. They should cover the ‘5 – Ws’, what, where, when, why, and who. A common rule of content to adopt is 90% specific and 10% general.

Getting Started

Getting organized to begin the process of procedure writing requires several administration steps. The first step is to determine what kind of procedure system do you require. This can be determined by reviewing your current procedure situation.

- Do procedures exist?

- Are these procedures current?

- Is there a common procedure?

- Are or will the current procedures required for a regulatory certification?

- Review current situation

- Determine required control

- Pick a procedure format

- Start a procedure log

- Educate procedure writers

Getting Started

The answers to these questions will assist in determining the level of control required manage your procedures.

The next steps are to select the proper procedure format for your system and develop a procedure log to establish procedure requirements. There is no one standard procedure format. Selecting a procedure format is a matter of reviewing possible styles and selecting the one suited best to meet your requirements. If a certification, like ISO 9000, is factor a specific procedure format or content may be required. . Check with you registrar for recommendations. Establishing a procedure log through the course of the implementation will allow written procedures to be documented and tracked. Establishing this log prior to the business pilot will allow you to determine the scope of procedure writing required for your implementation. Some of the most common elements of a procedure log are procedure numbers, titles, revision level, functional area, person responsible, approval responsibilities, and related dates.

Once the procedure system and format have been established, the next step is to select and educate procedure writers. Often the best people to write the procedures are the ones responsible for the tasks. The selected procedure writers should be given proper education on what is expected and to review the selected procedure format and content. Practicing flowcharting business processes is an excellent way to begin the process and to develop proper technique. Flowcharting helps to understand the level required and where additional or smaller procedures are needed. After completing the flowchart, the procedures can then be easily written in the specified format or in a draft fashion for a clerical person to input for review. The final step is to review, approve, and distribute the finished procedures.

Procedure for writing a procedure

1.0 Purpose

1.01 The purpose of this procedure is to detail the requirements necessary in documenting a procedure

2.0 Scope

2.01 All procedures must be prepared on standard format paper.

2.02 All procedures must have as a minimum the following:

- title

- procedure number

- issue number

- date

- page number

- purpose

- scope

- responsibility

- definition

- procedure itself

- references

2.03 The decision, as to whether or not a written procedure is necessary, should be taken on the basis that if the absence of such a procedure could adversely affect the quality of work being performed, then a procedure is necessary.

2.04 The language used in a procedure should be specific enough to avoid ambiguity and general enough to ensure it is practical.

2.05 Documentation Control controls the issue of the procedure numbers and the procedure log.

3.0 Responsibility

3.01 Primary responsibility for the adherence to the requirements of this procedure shall rest with the originator, with contributing responsibility from the appropriate Function Head.

4.0 Definitions

4.01 Function Head.

The Function Head is defined as the manager for the area in which the procedure will be performed.

4.02 Originator.

The preparation and writing of a procedure shall be undertaken by personnel familiar with the function to be controlled. The person(s) so defined shall be the originator of the procedure.

4.03 Controlled Document.

Authorized copies of procedures, which are produced on the colored pro-forma paper, shall be classified as controlled documents.

Authorized copies of procedures, which are not on colored pre- printed paper, shall be classified as uncontrolled documents, i.e. photocopies.

5.0 Procedure

5.01 The Originator will prepare a draft procedure.

5.02 The Originator will then forward the draft procedure to all departments affected by the procedure for their comments.

5.03 Departments are normally given two weeks to respond with their comments. (Originators should specify in a covering memo, the deadline for comments and circulation list.)

5.04 Comments are taken into account and the procedure modified if necessary. The Project Leader will arbitrate on any disagreements.

5.05 The Originator signs and dates the document under the Approval Section.

5.06 Document Control issues official copies of the procedure.

6.0 Reference Documents

6.01 The references shall identify all procedures, operating instruction, and documents referred to within the procedure, which are not part of the procedure itself.

Sample Procedure Format

| Title |

|

| Originator |

|

Procedure Title |

|

Issue Number |

|

| Approval |

|

Procedure Number |

|

Issue Date |

|

1.0 Purpose

Objective of the procedure.

2.0 Scope

To what activities the procedure applies.

3.0 Responsibility

Who is responsible for implementation?

4.0 Definitions

Terms or words not readily understood.

5.0 Procedure

Step by step instructions of each activity stating:

- What is done?

- By whom?

- When, where, and possibly why?

6.0 Reference Documents

Any other documents or referred to activities.

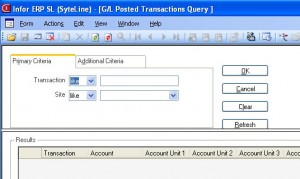

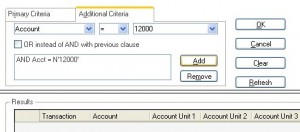

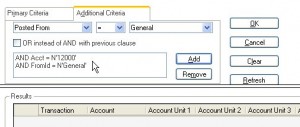

Select “Posted from”, let it “=” to General. That means we will only select transactions that is posted from “General Journal”, instead of normal inventory transactions that are posted from “IC Journal”. Then click the “Add” button.

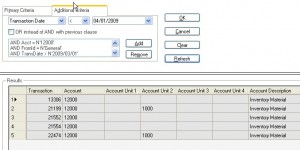

Select “Posted from”, let it “=” to General. That means we will only select transactions that is posted from “General Journal”, instead of normal inventory transactions that are posted from “IC Journal”. Then click the “Add” button. Right click on left-upper corner of the grid, from the menu, select “To Excel”, you will then be able to export the data to Excel.

Right click on left-upper corner of the grid, from the menu, select “To Excel”, you will then be able to export the data to Excel.

Recent Comments